While there is no actual movement of cash in this scenario, the business has accrued $150 worth of revenue and expenses. The accrual adjustment will debit the current asset account Accrued Receivables and will credit the income statement account Accrued Electricity Revenues. A company might look profitable in the long term but actually have a challenging, major cash shortage in the short term. For example, a company might have sales in the current quarter that wouldn’t be recorded under the cash method. An investor might think the company is unprofitable when, in reality, the company is doing well. This would get entered as a liability on your general ledger while acknowledging an obligation to the creditors.

Accrual Accounting vs. Cash Basis Accounting: What’s the Difference?

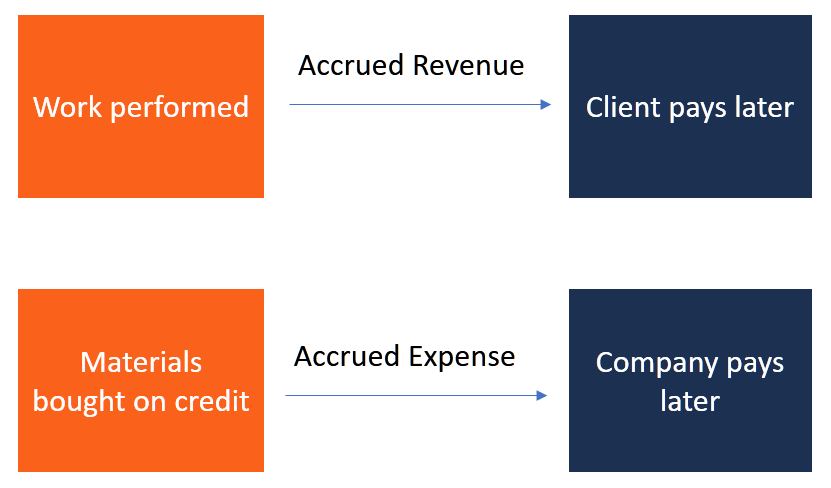

Accrued expenses are recorded in the financial statements as a liability, and are recognized when the expense is incurred, not when payment is made. The accrual accounting method gives a clear picture of your liabilities and revenues. It’s a standard accounting practice that lets you better anticipate revenues and keep liabilities in check. Accrued expenses are similar to accrued revenues in the sense that you were recording when the transaction happened, and not when there’s a payment. Accrual accounting helps your business keep track of when financial transactions actually happen. If your company only records money when it comes in or goes out, you miss key details about when you earned money or had expenses.

Is there any other context you can provide?

Accrual accounting is good for larger, public businesses, companies of any size that have to deal with inventory, and businesses that have earned more than $25M gross over 3 years. It’s also beneficial to a growing company, or any company that wants to use GAAP-compliant methods. If you plan on growing your company, it may be easier to start with the accrual method of accounting, so you don’t have to make the switch while your business is up and running. The received capital can then be moved to other accounts, such as free cash, if needed—the company uses the same double-entry method to enter which account the capital came from and is moved to. This would mean that net income does not accurately represent what the business earned because expenditures have been moved around instead of recorded where they actually occurred. For example, let’s say that Company A has accrued revenue and expenses on their books.

Accrual Method

Another disadvantage of the accrual method is that it can be more complicated to use since it’s necessary to account for items like unearned revenue and prepaid expenses. Revenue recognition is important because it determines the timing of when a company reports its revenue. Accurately recognizing revenue is crucial for a company’s financial reporting and analysis.

Accrual accounting differs from cash accounting because it includes revenue that has yet to be collected (accounts receivable) and expenses that have yet to be paid out (accounts payable). Companies might also use modified accrual accounting and modified cash basis accounting. However, the cash basis method might overstate the health of a company that is cash-rich.

- He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses.

- It’s worth noting that accrual accounting is the opposite of cash basis accounting.

- Accrual accounting is not simple and requires thorough record keeping, with close attention to detail.

- As mentioned above, businesses that track inventory must use accrual accounting, and retailers are no exception.

- Under the accrual method, the $5,000 is recorded as revenue as of the day the sale was made, though you may receive the money a few days, weeks, or even months later.

What Are the Advantages of Accrual Accounting?

This method provides a more accurate picture of a company’s financial health, as it takes into account all transactions, whether they have been paid or not. Accrual accounting is a method of accounting that recognizes revenue and expenses when they are earned or incurred, regardless of when cash is received or paid. This means that revenue is recognized when it is earned, even if the customer has not yet paid for the goods or services. Similarly, expenses are recognized when they are incurred, even if the company has not yet paid for them.

This means a purchase will only be recorded once the invoice is paid in full, while expenses are only noted once they’ve been paid and the money leaves the bank. The main difference between accrual and cash accounting is when transactions are recorded. Accrual accounting recognizes income and expenses as soon as the transactions occur, whereas cash accounting does not recognize these transactions until money changes hands. Accrual accounting provides a more accurate picture of a company’s financial position. However, many small businesses use cash accounting because it is less confusing. Larger companies are required to use the accrual method of accounting if their average gross receipt of revenues is more than $25 million over the previous three years.

Similarly, expenses are recognized when they are incurred, regardless of when the payment is made. This method provides a more accurate representation of the financial health of a business, as it reflects the economic activity that has taken place during a specific period. Under the cash basis method, transactions are recorded when cash is received or paid out.

To learn more about accounting principles and standards, check out our article on accounting principles. It’s beneficial to sole proprietorships and small businesses because, most likely, it won’t require added staff (and related expenses) to use. To address the challenge of complex rules and regulations, companies need to invest in training and accruals definition education for their accounting staff. This can include attending seminars and workshops, as well as providing ongoing training and support. Accrual accounting is not simple and requires thorough record keeping, with close attention to detail. Depending on the size and complexity of your company, you may need to hire a professional accountant.