They, therefore, record a journal entry by debiting the bad debt expense and crediting the allowance for doubtful accounts. The allowance for doubtful accounts resides within your balance sheet’s “contra assets” division. However, contrary to subtracting it, you actually incorporate it into your overall accounts receivable (AR).

Specific identification method

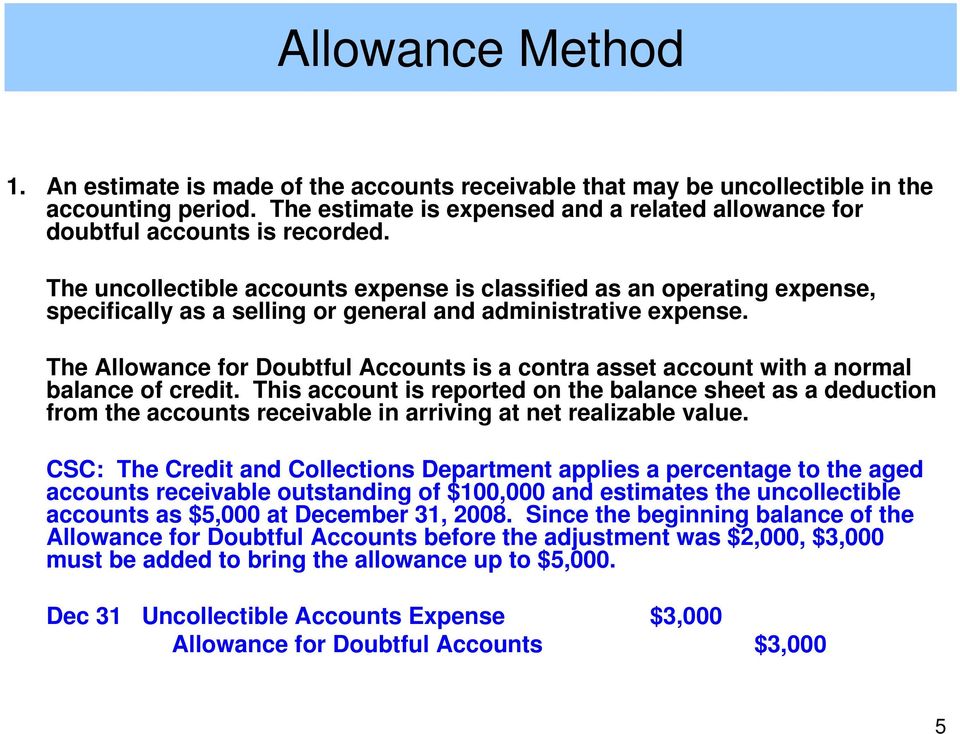

The allowance method aligns with generally accepted accounting principles (GAAP), particularly the matching principle. By recording expenses in the same period as the related revenue, businesses ensure compliance with accounting standards and improve the accuracy of their financial reports. Well, rather than waiting for customers to default and hit you with unexpected financial hiccups, you can prepare in advance.

Heating and Air Company

- Companies often have a specific method of identifying the companies that it wants to include and the companies it wants to exclude.

- This typically occurs after you have executed exhaustive collection efforts and negotiations.

- The accounts receivable method is considerably more sophisticated and takes advantage of the aging of receivables to provide better estimates of the allowance for bad debts.

- Now that you have got a grasp of what an allowance for doubtful accounts is and why it’s vital for your financial strategy, let’s understand how to calculate it.

Accounts receivable is presented in the balance sheet at net realizable value, i.e. the amount that the company expects it will be able to collect. The adjustment process involves analyzing the current accounts, assessing their collectibility, and updating the allowance accordingly. Founded in 2017, Acgile has evolved into a trusted partner, offering end-to-end accounting and bookkeeping solutions to thriving businesses worldwide. Download our customer success story to find out how Staples reduced their bad debt by 20% with automation and AI. Manual processes, while once the norm, can now be a bottleneck, leading to missed opportunities and increased risks. The good news is that the evolution of technology has given you powerful tools to transform your operations and supercharge your collections strategy – Automation and AI.

How an Allowance for Bad Debt Works

You’ll notice the allowance account has a natural credit balance and will increase when credited. The first step in accounting for the allowance for doubtful accounts is to establish the allowance. This is done by using one of the estimation methods above to predict what proportion of accounts receivable will go uncollected. For this example, let’s say a company predicts it will incur $500,000 of uncollected accounts receivable. Some companies may classify different types of debt or different types of vendors using risk classifications. For example, a start-up customer may be considered a high risk, while an established, long-tenured customer may be a low risk.

Is Allowance for Doubtful Accounts an Asset?

This method provides a more granular view of potential uncollectible accounts, allowing businesses to adjust their estimates based on the aging of their receivables. When establishing the allowance, businesses record a journal entry that debits the bad debt expense and credits the allowance for doubtful accounts. This entry anticipates potential losses, aligning with the matching principle by recording the expense in the same period as the related revenue. If the bad debt exceeds the allowance for doubtful accounts, it indicates that the company underestimated the risk of uncollectible accounts.

Why Is It Crucial to Create an Allowance for Uncollectible Accounts?

Businesses must regularly review and adjust their estimates to align with actual collection experiences, ensuring that financial statements remain reliable. First, the company debits its AR and credits the allowance for doubtful Accounts. In certain situations, there may be instances where a customer is initially unable to pay, resulting in a bad debt write-off. However, after a few weeks or months, the customer manages to make the payment and clear their dues. Offering trade credit can be a tricky maneuver for businesses as it can lead to non-payment, late payments, or delinquent accounts. Properly managing the allowance for doubtful accounts ensures that your financial statements are accurate and up-to-date.

If a customer purchases from you but does not pay right away, you must increase your Accounts Receivable account to show the money that is owed to your business. Peter’s Pool Company, based in Tampa, Florida, has estimated the balance allowance for doubtful accounts to be 14k. For the purposes of this example, let’s assume the 14k is 100% accurate and that none of that amount gets collected from the company’s clients. Accounts use this method of estimating the allowance to adhere to the matching principle.

Suppose that a firm makes $1,000,000 in credit sales but knows from experience that 1.5% never pay. Then, the sales method estimate of the allowance for bad debt would be $15,000. Yes, allowance accounts that offset gross receivables are reported under the current asset section of the balance sheet.

The company now has a better idea of which account receivables will be collected and which will be lost. For example, say the company now thinks that a total of $600,000 of receivables will be lost. The company must record an additional expense for this amount to also increase the allowance’s credit balance. It’s is allowance for doubtful accounts a permanent account important to note that an allowance for doubtful accounts is simply an informed guess and your customers’ payment behaviours may not exactly align. This could mean more customers fail to pay and you wind up with more uncollectible accounts, or you might have overestimated your allowance for doubtful accounts.

For companies having minimal bad debt activity, a quarterly update may be sufficient. You can also evaluate the reasonableness of an allowance for doubtful accounts by comparing it to the total amount of seriously overdue accounts receivable, which are presumably not going to be collected. If the allowance is less than the amount of these overdue receivables, the allowance is probably insufficient. This provision not only helps in presenting a more accurate picture of a company’s financial status but also ensures compliance with accounting standards. Explore the components, estimation methods, and financial impact of the allowance for doubtful accounts in this comprehensive guide.

You’ll notice that because of this, the allowance for doubtful accounts increases. A company can further adjust the balance by following the entry under the “Adjusting the Allowance” section above. This is different from the last journal entry, where bad debt was estimated at $58,097.